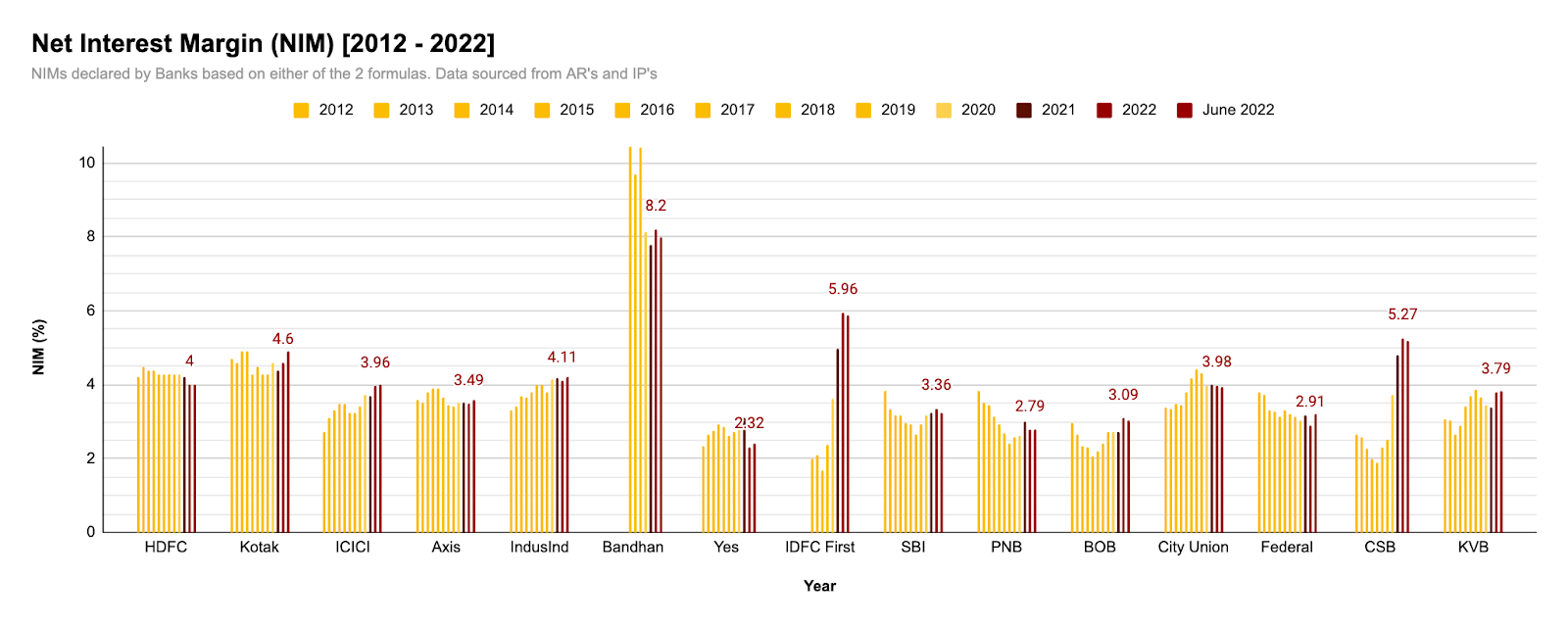

The main Raw Material for a bank is Money.

A bank borrows money from depositors at say 5%, packages that money as a loan and lends it, at let’s assume 12%.

It earns Income in the form of EMIs, pays back the depositors who gave it the money, what’s left is called – Net Interest Income.

On top of that, a bank also earns in the form of fees and commissions – ATM fee, Debit/Credit issue fee, loan processing fee, non maintenance of minimum account balance fee

You name it, the bank will charge a fee for it !

This adds up to Total Income.

From this, it needs to pay staff salaries, rent for branches, technology costs, these are the operating Expenses..

Then it also has to pay the money on behalf of people/companies who took the loan but didn’t pay back. This is the NPA cost.

And finally after paying tax to the Government. What’s left is profit after tax (Net Profit) etc.

But, how to know which bank is better than the other?

We use 3 key metrics.

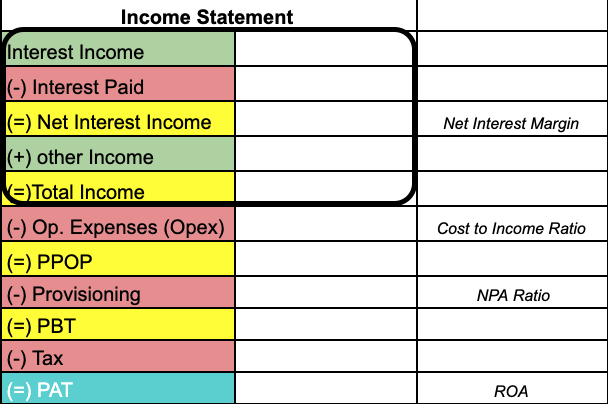

Net Interest Income as % of Total Assets tells us how efficiently a bank can turn 100 rs of assets into Income. This is called Net Interest Margin – the higher the better.

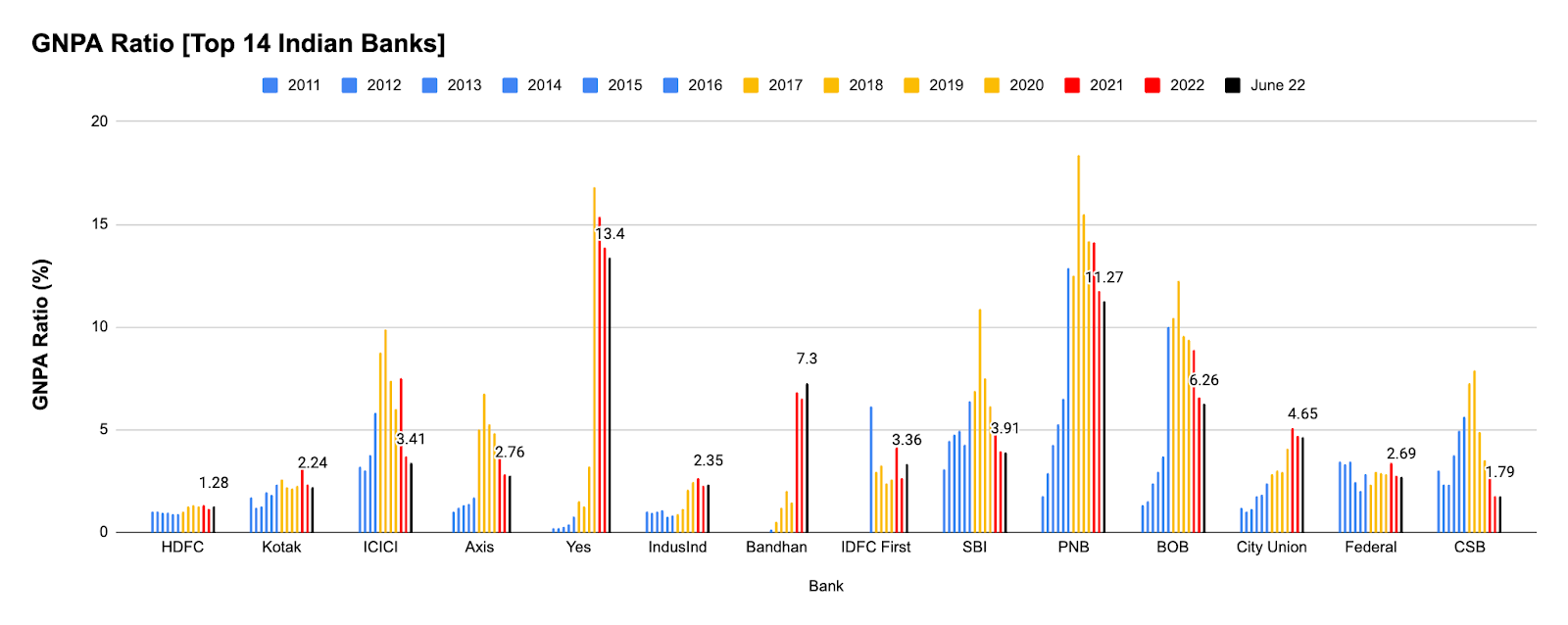

Secondly, What % of Total Assets are going to waste, meaning, the bank lent the money but didn’t get it back. This is called NPA – lower the better.

Lastly, for every 100 rs of Assets, how much profit can a Bank generate, so Profit/Total Assets, called ROA. Higher the better.

Now, let’s do a quantitative analysis of the Top 15 banks using these metrics

This chart shows Net Interest Margin for the last 10 years + June 22 quarter.

In our ROA Tree video, we discussed how Net Interest Margins are the first driver of ROA, and therefore, we want to set the cut-off level to ~ 4%

If it is either close to 4% or above, for the purpose of this analysis we will consider the bank to have passed our cut-off limit .

So, HDFC, Kotak, ICICI, Indusind, IDFC, Bandhan, City union and CSB bank meet our cut off requirement.

So, 8 Banks meet the first cut-off out of a Total of 15.

Now, moving on Asset Quality, the importance of which has again been explained in the ROA Tree video in more detail & we recommend you check it out after reading this article for a more in-depth understanding on analyzing bank/NBFC Stocks.

Just a little disclaimer that the business model of a bank and types of loans it gives massively impacts what the appropriate GNPA range should be but to keep things simple for now, we can agree that GNPA Less than 5% is our minimum cut-off.

So, Out of the 8 banks in Chart 1, only Bandhan Bank fails the Asset Quality test.

Which leaves us with – HDFC, Kotak, ICICI, Indusind, IDFC, Bandhan, City union and CSB bank

I should add here that, although Bandhan’s NIMs are so far above any other bank, it comes with higher risk too because Bandhan’s business model focuses on lending to the bottom of the pyramid, where it can earn very high interest rates but which also come at much higher risk.

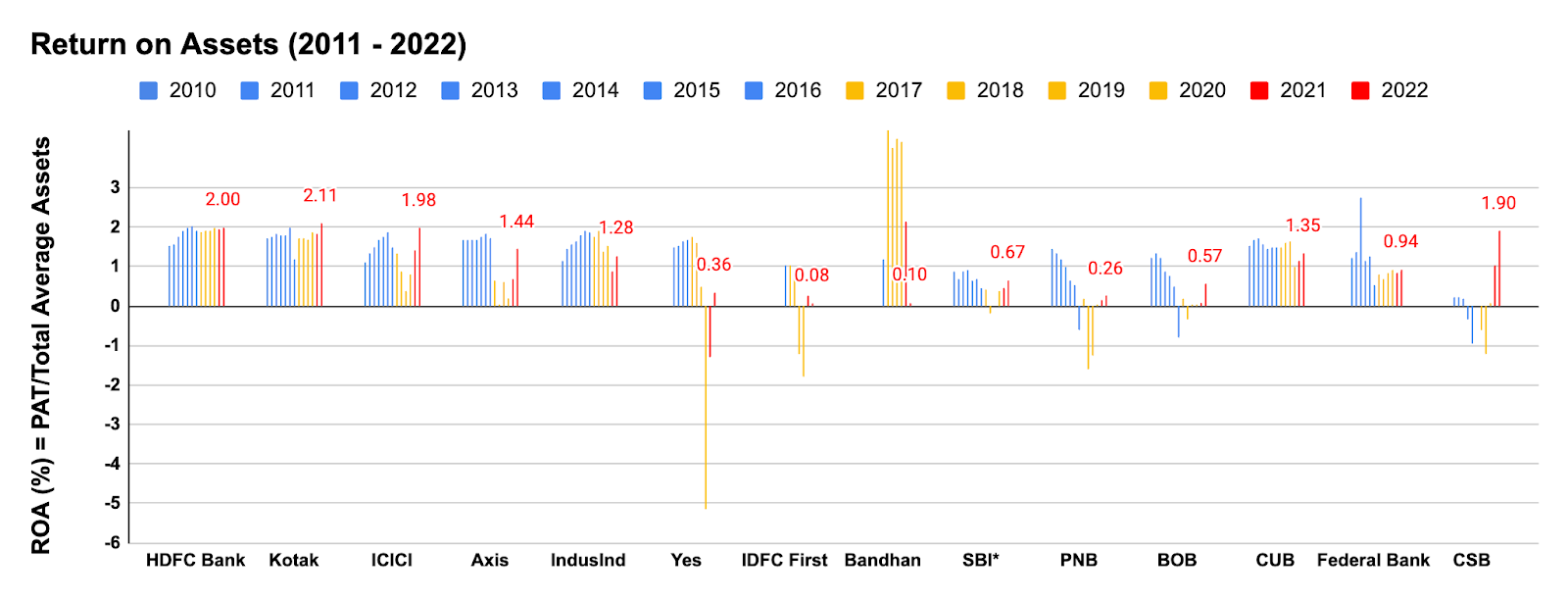

The ultimate test is the ROA – the litmus test for profitability and efficiency for a Bank.

Anything below 1% is unacceptable.

Which means out of the 8 Banks that qualified the NIM filter, 7 banks in the NPA filter, we now have HDFC, Kotak, ICICI, CUB and CSB remaining.

IndusInd Bank also qualified the ROA Test but we have removed it from our list since, personally, we believe it has many qualitative issues.

So, 5 out of 12 Banks make it to our final list.

Now, the next set of questions should be on valuation & Growth :

Q. How to know which Bank stock stocks are available cheap and not so cheap?

Q. For How long Should we invest in these Bank Stocks?

Q. How much should we invest?

Q. What are the potential Risk factors?

Q. When to sell?

Which one of these are most important for you?

Let us know in the comments below and we will try to write a more detailed blog on the topic.

Disclaimer :

- I am NOT a SEBI Registered Investment Advisor, but then again, this is NOT investment advice. This post is best interpreted as Educational

- Despite my suggestions that Nifty Bank may be a reasonable purchase, along with the risks highlighted above, I personally have not invested in Bank Nifty in the 3 months prior or since writing the post.