Quantamental Strategy Review – 27th October 2023

Overview

58 Unique Stocks were Traded in Since April 2023

19 of these companies were the ones I invested in for the First Time. Meaning they were not part of my PF before April 2023

These 19 companies will be the subject of this Analysis and are listed below

Meaning they were not part of my PF before April 2023

The remaining 29 positions I added to or trimmed etc were already a part of my PF

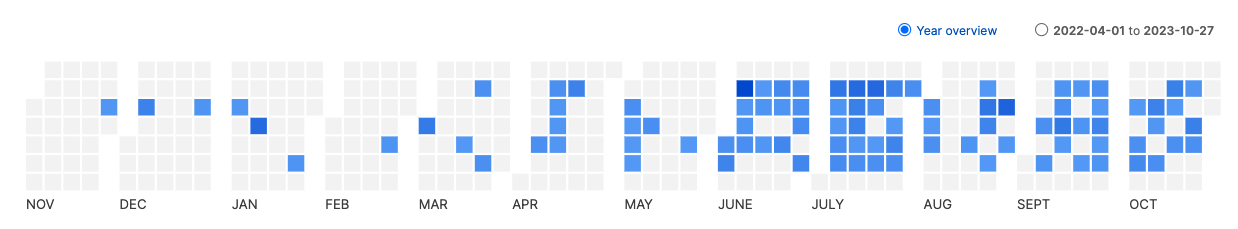

The above Graphic shows that trading activity picked up from June in a big way, trailing the bull run we’ve seen since April 2023.

Also until May 2023 I was busy with my CFA exam and may be another reason activity was less.

Having said that, these last few months represent the highest ‘activity’ on my part as an investor which is a direct reflection of my shift towards ‘playing the Quantamental strategy’ a.k.a Techno Funda approach to investing as some may call it.

Also take note that as a part of my overall PF, Quantamental Strategy represents a very tiny part because at this point this is an experiment and I am obviously learning if/how to create my own way of making this work (if at all)

That is precisely the point of this Research Study, which is to Analyze my trades, and learn lessons from it to make my process more robust.

T-19

| Foseco Ltd | Sanghvi Movers | Suzlon | PTCIL |

| CMS Info | SouthIndian Bank | IWEL | Vadilal Ind |

| Indigo | TTK Healthcare | Dynamic Cables | Shilchar Tech |

| PFC | Talbros Auto | Foods & Inns | Coal India |

| Kama Holdings | Andhra Paper | KSCL | PCBL |

The companies highlighted in the Green are the ones where on a net basis I made money

The unhighlighted ones are where I lost money on a net basis.

Obviously, as far as Hit to Miss ratio is concerned, the batting average at this point stands at 7/19 or ~45% so yeah, not great !

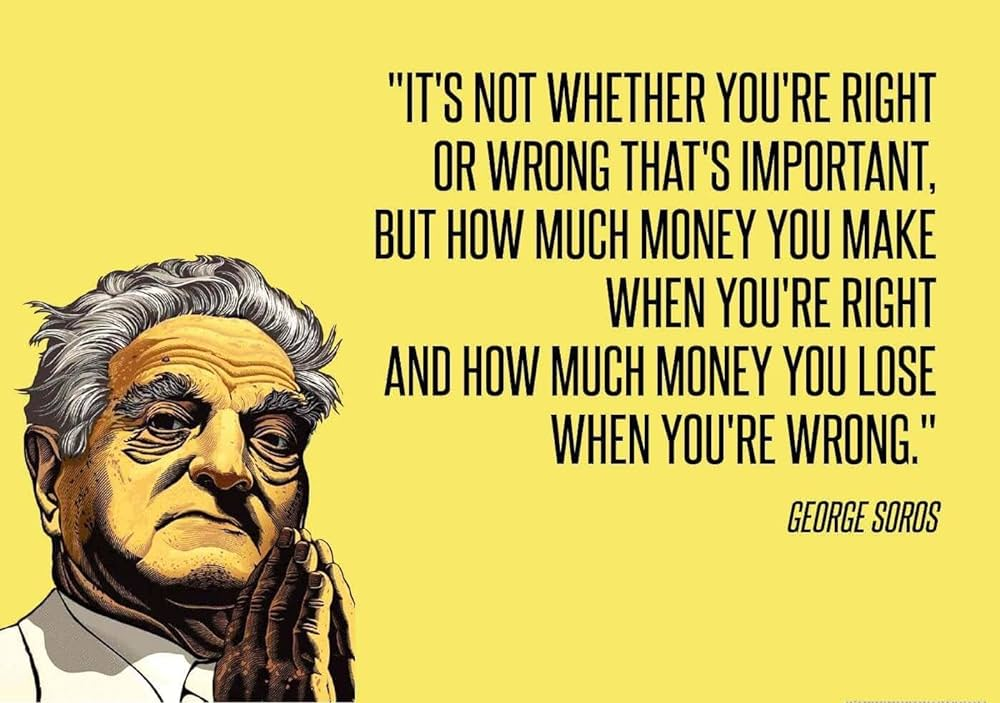

To make myself feel better, I will insert a quote by George Soros that better reflects how things should be viewed

We will be calculating the net results (holding my breath) as we go along in this research article and that should be a better way of looking at how my decision making fared over the last 6 months.

Let’s start with the losers 😣

| Symbol | Realized & Unrealised P&L |

| SOUTHBANK | -14225 |

| SOUTHBANK | -13373 |

| TALBROAUTO | -10214 |

| KAMAHOLD | -9428 |

| FOODSIN | -9183 |

| SUNFLAG | -8305 |

| FOODSIN | -7495 |

| MAITHANALL | -5971 |

| VEDL | -4150 |

| ANDHRAPAP | -3362 |

| PCBL | -2540 |

| KSCL | -1753 |

| VADILALIND | -1360 |

| PTCIL | -620 |

| CSLFINANCE | -44 |

| TTKHLTCARE | -34 |

| Total | -92056.35 |

Shaded Rows represent companies where I still have a position and these include unrealised losses. The unshaded rows are obviously the realized losses !

For Example, you will see 2 entries for South Indian Bank, it means that I have a realized loss on the bank and a Current position where an unrealised loss exists.

This data is until the 27th October 2023 – So please keep this in mind.

I wanted to include both because I wanted to compare the Net result of my decisions post April 2023, which involved elements of Techno-Funda Approach and it would’ve only been fair if both unrealised and realized numbers are compared.

After all, I Want to know the Truth

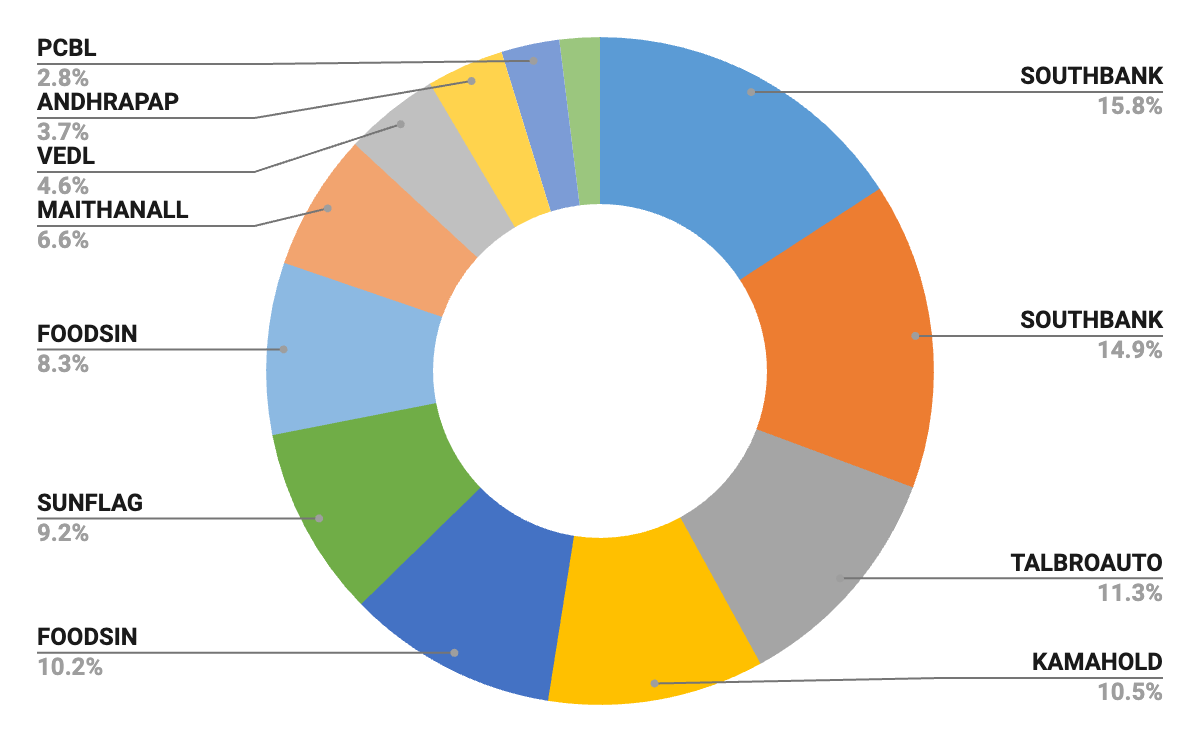

Visually, if we represent the unrealised and realized losses from my Quantamental strategy, it looks something like this

Not sure how to interpret it but I would say a few thing are obvious :

- Losses are relatively more fragmented vs. the Gains (as we shall see soon)

- This fragmentation is good in the sense that the ‘strategy’ may result in smaller losses from multiple rather than big losses from a few.

- The above might also be a reflection of my general rule (not applied always) or lack thereof of limiting losses to 10-15% (More on this later)

- Out of the above companies, I am still holding onto Kama & South Indian Bank and Foods & Inn despite booking some losses so what’s that about?

Before we get into more details about analyzing losers and how to minimize them, let’s quickly also take a look at the winners (infused with plenty of luck of course)

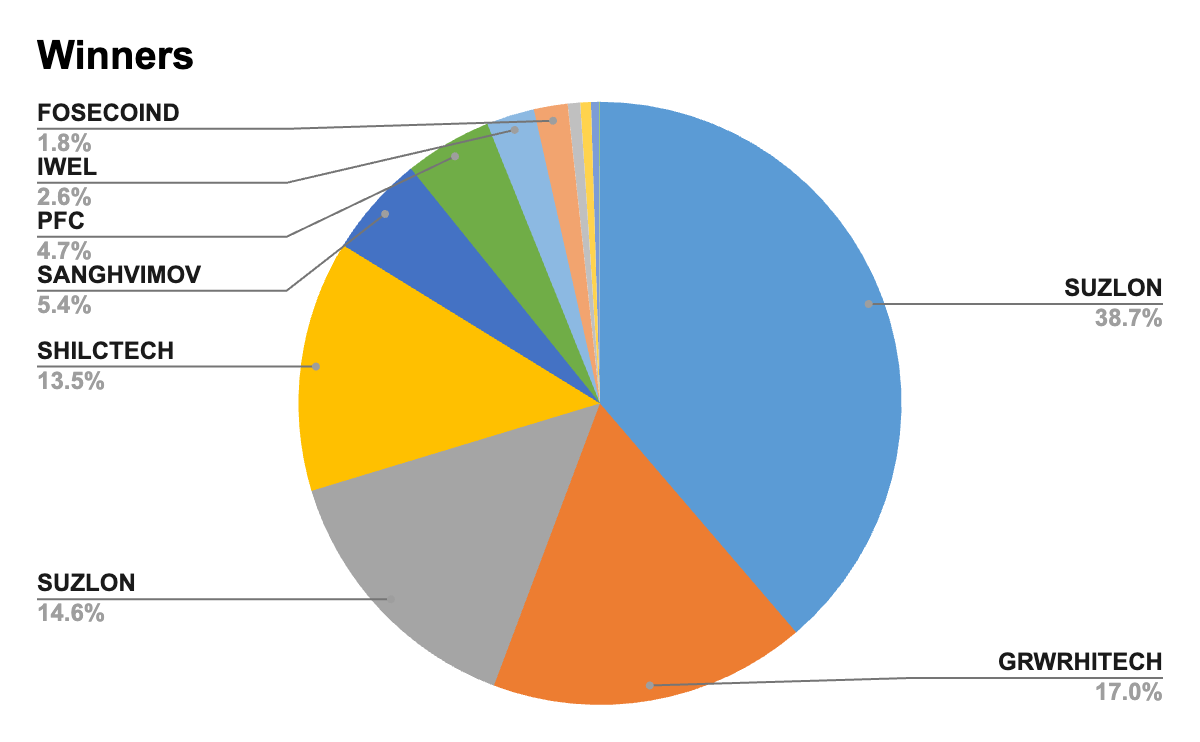

Looking at the above Winners, there are a few observations that come to mind :

- You see, compared to the losses, Winners are a lot more concentrated. For Example, Suzlon, Garware Hi-tech and Shilchar account for most of the gains.

- This relative concentration (relative to the fragmented nature of losses shown above) maybe a natural outcome of the ‘strategy’ wherein as the stock moves higher + you are able to get confidence from the fundamentals (Critical for increasing position at higher prices)

| Symbol | Net |

| SUZLON | 93265.75 |

| GRWRHITECH | 40949.8 |

| SUZLON | 35143 |

| SHILCTECH | 32448.7 |

| SANGHVIMOV | 13061.3 |

| PFC | 11297.8 |

| IWEL | 6201.7 |

| FOSECOIND | 4365.6 |

| KAMAHOLD | 1600.3 |

| COALINDIA | 1367.15 |

| DYNAMIC | 1019.35 |

| INDIGO | 126.5 |

| CMSINFO | 14.6 |

| Total | 240861 |

If we take the two together, we get a Win to Loss Ratio = 2.25 X

(Actually it’s 2.7X but reduced to 2.25X to factor in well, luck, errors and all things in between)

There are additional caveats to keep in mind while interpreting this number :

- This was an experiment and it was executed on small sums of Total capital, therefore even though the Win to loss ratio appears not too bad, it has not done anything on a PF level.

- Secondly, is this scalable? Big Question which I will try to understand and outline later in this study.

- It’s not so much about Win to loss and really about Return on capital Employed, like how much capital was required to get a net gain of (240,000 – 92,000 = 148,000). My estimate is that ~10 Lacs of Capital was required to carry out this experiment. So ~ 14.5% Return in a 6 month period. Don’t get too excited about this number, there’s more.

- And additionally, If this strategy is scalable, is it worth the effort? Would you not be better off using this time in discovering/researching stocks through other methods because really the idea behind this strategy is to have big winners which can move the PF in a shorter time frame and by definition a bet that can move the PF has to be somewhat sizeable but higher sizing also increases risk and therefore, by definition there will be a very few stocks that will become big winners for YOU. If this sounds confusing, I will try to clarify soon.

So, there are some issues around how to interpret the above Win to Loss ratio and whether that is the best way to look at the result. Nonetheless, its a starting point.

What I really wanted to do with this study is to study the losers.

One by one and see if I can spot some discrepancies in my execution and maybe get some big lessons out of this.

So, let’s go !

| Symbol | Realized & Unrealised P&L |

| SOUTHBANK | -14225 |

| SOUTHBANK | -13373 |

| TALBROAUTO | -10214 |

| KAMAHOLD | -9428 |

| FOODSIN | -9183 |

| SUNFLAG | -8305 |

| FOODSIN | -7495 |

| MAITHANALL | -5971 |

| VEDL | -4150 |

| ANDHRAPAP | -3362 |

| PCBL | -2540 |

| KSCL | -1753 |

| VADILALIND | -1360 |

| PTCIL | -620 |

| CSLFINANCE | -44 |

| TTKHLTCARE | -34 |

| Total | -92056.35 |

Let’s begin with the larger ones and go all the way down

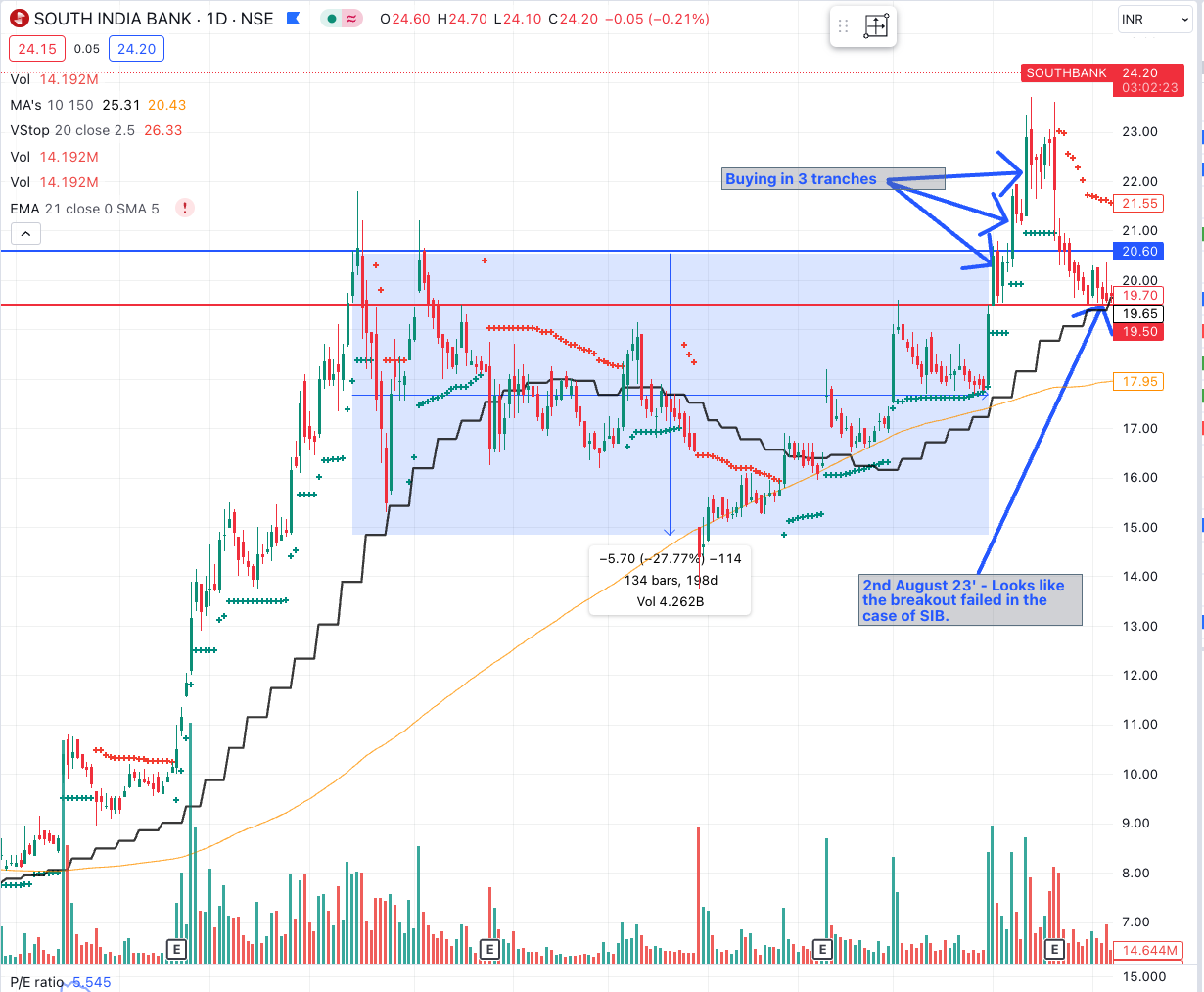

- South Indian Bank

Idea source/background : I have done extensive research work in the financial sector and when the sector was turning I remember I had invested in some of the better players in the banking & NBFC sector (some of best ones did NOT work out for me btw – Kotak & HDFC 👏)

Sometime during 2021/early 2022 when it was becoming clear that the sector was turning around I wanted to move cash from Bank to Bonds and while researching Corporate bonds on the platform Golden pi I came across bonds such as Credit Access which were offering ~9-10% and I knew It would be safe because CAG is a high quality operation and one of the best players in the MF, then i came across South Indian Bank which was offering yields of ~13% if I remember correctly and I was like, how desperate are they? Very ! if yields are any indication to go by

BUT the sector turned and all along Mr. Murlinathan was driving some key changes at the bank which I was too ignorant to study about and the very fact that my first thought about SIB was : What a piece of Crap !! is exactly the mental model that makes for the opportunity. Combined with other nuances such as sector turning etc.

Since then, I have made it a point to at least do some work on companies that make people recoil in disgust on hearing their names. And I applied this to Suzlon for example later on, which so far is working out okay.

And the stock went from ~ 8/share at July 22 bottom to ~21 when I entered.

Initial Buying Point :

I bought in 3 tranches on the 3rd, 7th & 12th July 2023 at an avg price of ~ 21.88

I got the idea from a Friend to be honest and I think he got it from hardcore value investing guys.

EPA – Entry Point Analysis

- Breakout on Huge Volumes

- Entry points were within ~10% of Breakout (At the time Entry point did not great because I of how I was reading the base length and height etc)

- Base length was roughly 3-4 months so a decent period of base formation (usually the longer the base the better)

I would say Entry points were actually pretty decent (looking back, at that point in time it didn’t seem so)

So, what happened next?

The CEO changed, Stock pulled back to 19.7 and I sold out like a pussy !

And made a note to myself, “Looks like the breakout failed”

Sadly, I did not write a BUY NOTE, which as it later turns out was a contributing factor in me selling out

checkout what I actually wrote at the time of Selling on the 31st of July.

Conclusion/Lessons :

- ALWAYS write a BUY NOTE. You have to have at least a starting thesis which can be later developed. Ideally, in the future I will have a checklist ready which I can fill out to check if Entry points are good, general thesis. Its okay if its not too detailed because at the point of Entry you are taking a tracking position and obviously you have not looked too deeply into the co’

- Create a better system for Follow up and keeping track of your existing ideas. There needs to be a SYSTEM that works for you ! Every person is unique and they way of doing things is unique, how much time you have is different etc but there has to be a system to track existing positions. Absolutely critical

- Enter Again at a higher price if the opportunity is good enough and I think it is and I did enter again as shown below. I mean its trading at 6X Pe and 0.77 P/B with an ROE of over 15%. It deserves at least 1 X P/B if nothing else in addition to any other price increase that may occur due to earnings coming in.

Looking back, I’m really thinking to myself WTF !! How dumb are you man !

- Anyway, the stock is currently down from my entry point and because this initially Quantmental idea is now backed by a Fundamental understanding, price variations begin to have lesser impact but then again, lets see how things play out.

Disclaimer : Obviously, this is not a recommendation and hopefully you’re a relatively well informed and sane investor so please do not simply buy/sell because of what I’m writing. Do your homework you lazy bum ! Consult your financial advisor etc etc. Please.

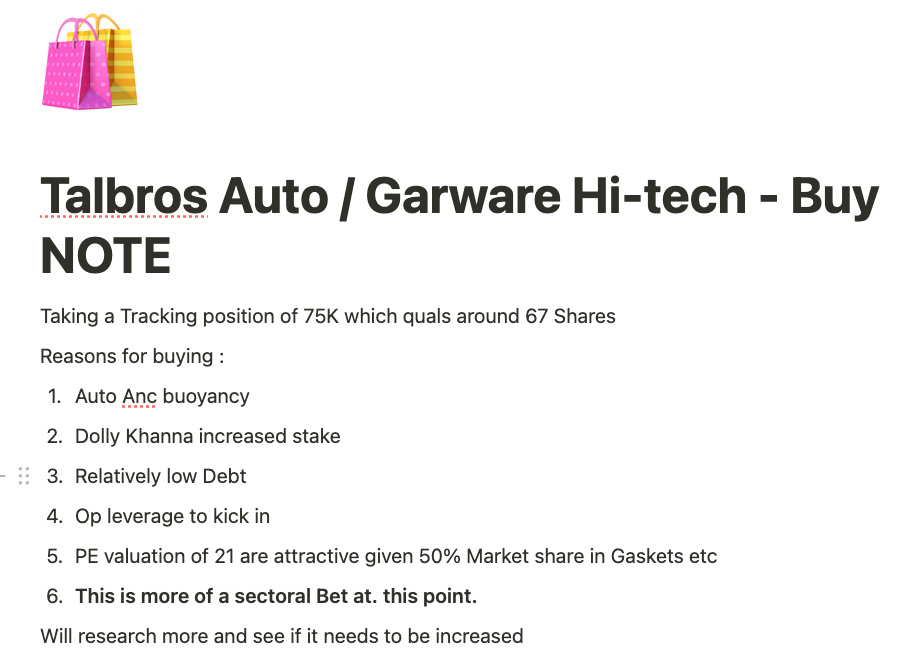

2. Talbros Auto

Idea background : As the buy note suggests, I bought this on the back of a few patterns – Big investor buying + Reasonable valuation + high market share in a sector experiencing buoyancy.

ENTRY POINT : I bought 68 shares at 1067 (pre 5:1 Share split equivalent to 1067/5 = 213.4)

Honestly, looking at my notes makes me ashamed.

The weak rationale and poor execution I’ve done is spectacular.

Just like SIB, the “Thesis” was not there and therefore when the market crashed, I Remember I was sitting in the waiting shed kind of room next to the Gamma Knife center at AIIMS hospital Delhi.

My mum was awaiting a laser treatment for treating a brain tumor that had stubbornly returned after having an incision operation in 2008.

I had my laptop and as a habit I opened to check what’s up with the PF (a habit I am fast realizing is not required nor does it do any good

honestly)

What’s more is the bias (based on reason or otherwise) I had in my mind that the market had run up a little ahead of itself and that a correction was likely, especially in the small-mid cap world, made me want to act even quicker seeing the declines.

I SOLD OUT AT 185.7/SHARE “LIMITING” my loss to a maximum 15%. I don’t know where I picked the 15% from.

Conclusion/Lessons :

- I need to update my system for generating leads, whetting them and factoring in the fact that with Quantamental kind of stocks there are some special consequences which need to be worked with : Lesser time to Research because stock is on the move. This introduces FOMO. How are we going to deal with that emotional aspect?

- I need to have a Thesis within 48 – 72 hours (or a fixed timeframe whatever it maybe) of initiating a tracking position – otherwise I must exit because what happens is that you keep generating leads and taking tracking position but you don’t do the more important work of understanding the rationale behind it and actually, this work should be done before NOT AFTER !! Once I have a

- I need to create a degree of separation between myself and my trading account. I have an addictive personality and I do not want to get stuck in this loop. I am already seeing the not so happy consequences of being too close to buying/selling. Maybe create a separate trading account for undertaking the QF strategy.

To be continued…