One of the viewers from our Youtube channel Mr Subhajit Biswas requested for comments on GTPL Hathway Ltd.

There are 5 data points mentioned by Mr. Biswas :

- 10 yr ROCE > 20%

- 7 Yr Sales growth > 15%

- Debt to Equity < 0.25

- Market capitalization > 1000 cr

- Stock Price fallen 60% from Peak

Let’s look into these data points

Firstly, ROCE is a super important ratio because it tells us how much operating profit (EBIT) a company can generate on the capital (Debt + Equity) it uses to run the business.

ROCE is comparable to an FD Return.

You put Rs. 100 in an FD and you get Rs. back (assume 6% rate, and ignore taxes), this means on a capital deployed of Rs. 100, your Return on Capital Employed is 6%

Naturally, you have higher hopes from a company than the bank FD, that is the whole reason you are willing to invest in a “Riskier” asset class – Equity !

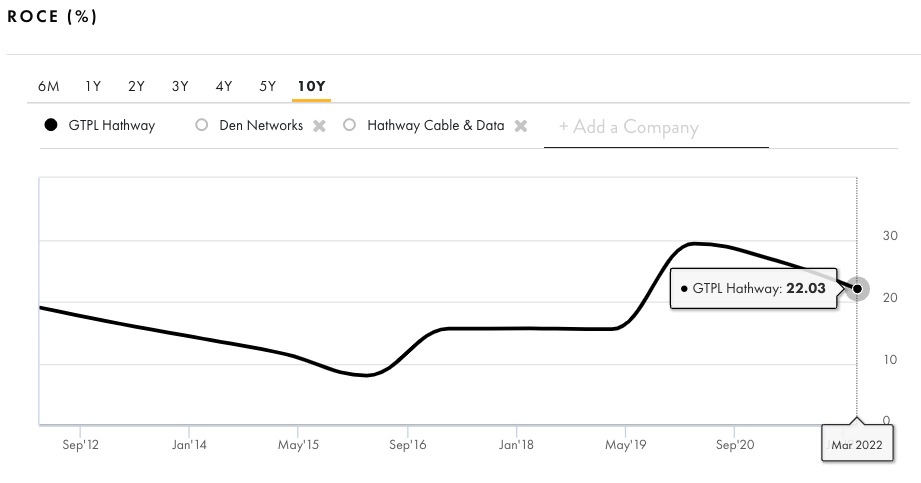

An ROCE of 20% is respectable by any standard and it is definitely a sign of a company with some sort of competitive advantage but that 20% should ideally be consistent, year on year with minor fluctuations allowed.

An AVERAGE of 20% over the last 10 years is not as great because a company could’ve gone through an upcycle where for 3-5 years it earned ROCE of way higher than 20%, which may skew the average number in the higher direction.

This may be the case with GTPL Hathway

Infact, the ROCE was higher than 20% only in the last 3 years !

Whether this Avg. ROCE performance of more than 20% is a thing of the past ? or will it likely sustain? is a question that really worth asking

And the question requires deeper understanding of the company’s Products/services, the industry dynamics, whether it is a cyclical industry or not, what are the competitive dynamics etc

I would suggest Mr. Biswas look into this aspects of the company

Secondly, Sales Growth of 15%+ over last 7 years is great and we would certainly prefer that but last 7 years is of no use if the outlook of the future is not great

You will notice that sales growth in FY21 was 3.5%, and in FY 22 was -2.1%

No wonder the stock has taken a beating since Sales growth is one of the most important drivers of value

I recommend you find out more about the growth drivers of the company going forward

Thirdly, debt to equity of < 0.25 is preferable to higher debt companies, the lower the D/E the better since one of the most common causes of company’s failure is excessive Debt

Fourth, Mr. Biswas mentions Market Capitalization of > 1000 Cr

Maybe what he is suggesting is that because it’s a small cap it is likely to grow faster?

That might be true given other factors required for growth are in place.

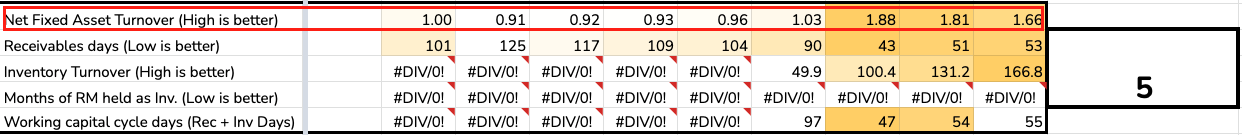

We can get a perspective on growth by understanding the NFAT – Net Fixed Asset Turnover

Basically, Sales/Net Fixed Assets required to support that growth

The NFAT of GTPL is around 1.7-1.8 over the last 3 years

This means that for Every Rs. 100 worth of Net Fixed Asset , the company can generate ~ 170 – 180 Rs of sales

This means that to 2X its sales from ~ Rs. 2500 Cr to Rs. 5000 Cr, it will require around ~ Rs. 2950 Cr worth of Investment into Fixed Assets

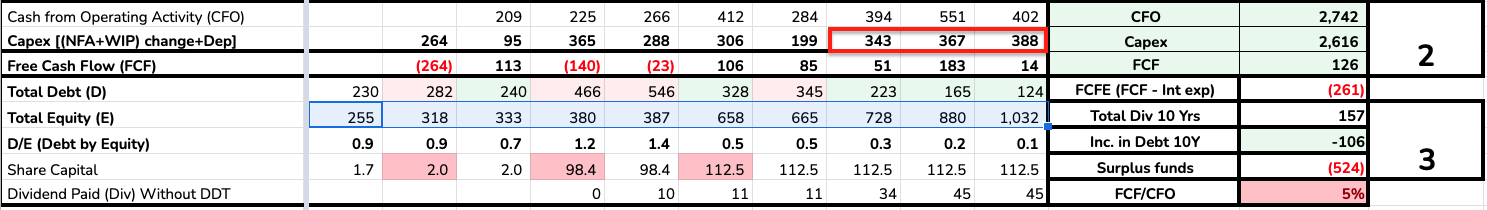

Assuming it is possible to grow to that number in the company’s respective industry, at the current Investment rate of ~ Rs. 350 Cr per year, It will take ~ 8 years to make that kind of investment in Fixed Assets !

Or, the company will take on Debt to make that process faster, which will in turn increase Debt to Equity, which will likely lower Net profit margin since a higher percentage of operating profit will get eaten up by Interest Costs.

It might not necessarily take 8 years to actually double sales, since there may be existing capacity/assets that are not fully utilized but you get the point – This business will require large amounts of capital to grow !

Large amounts of capital that it does NOT generate internally, at least not enough to 2X sales in 3-5 years !

Lastly, Mr. Biswas mentioned Stock Price has fallen by more than 60% from the peak !

I believe that this might be real reason for Mr. Biswas’s interest in the stock

This is a psychological bias. We get anchored on the higher stock price, at the peak and we unconsciously assume that this is the true value and somehow that 60% fall in price is somewhat equivalent to a discount of 60%

Nothing could be further from the truth !

I know this because I have seen practically every new/untrained investor fall for this trap !

I fell for it myself when I invested in Vakrangee in 2017-18 or when I invested in Newspaper Stocks

Often, with such cases we don’t realize that the peak share price at Rs. 296/share might have been overvalued to begin with !

In closing, I would suggest some homework to Mr. Biswas and share his findings with other viewers/readers of First principles Investing

- What are the Growth prospects ?

- Is the Industry Cyclical or non-cyclical in nature ?

- How & Why is it able to maintain Operating margins ~ 20% + levels, and is this likely to continue in the future?

- Does it have questionable related party transactions with the promoter group? You use our youtube video on RPT to answer this question.

If you face any issues or have questions, please feel free to contact at info.firstprinciplesinvesting@gmail.com